iowa capital gains tax exclusion

In April Vermont conformed to the federal. Form 2439 Notice to Shareholder of Undistributed Long-Term Capital Gains must be completed and a copy given to each shareholder for whom the REIT paid tax on undistributed net long-term.

How High Are Capital Gains Taxes In Your State Tax Foundation

Combined rate65 which does not account for the 30 exclusion Standard deductions can phase out to 0 at 106160 for singles and.

. Use HomeGains Capital Gains Calculator to determine if your gain is tax free or how much capital gains tax is owed from the sale of a property. Because your peace of mind is priceless. In this episode of the SALT Shaker Podcast policy series Eversheds Sutherland Partner and host Nikki Dobay speaks with Brad Scott Director of Finance of Halstead BeadBrad has become an advocate for sales tax simplification post Wayfair.

This provision is found in Iowa Code 422721. Division III Retired Farmer Capital Gain Exclusion. However you can avoid at least a portion of the tax.

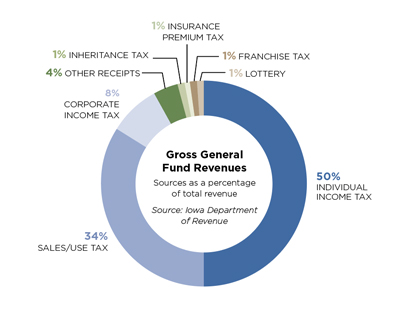

Taxable income of 0 to 20550. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable. Tax Bulletins usually clarify the application of existing laws and regulations to new or disputed circumstances but for the second time in as many years Pennsylvanias Department of Revenue arguably went further adopting new nexus standards for corporate income tax purposes in a bulletin.

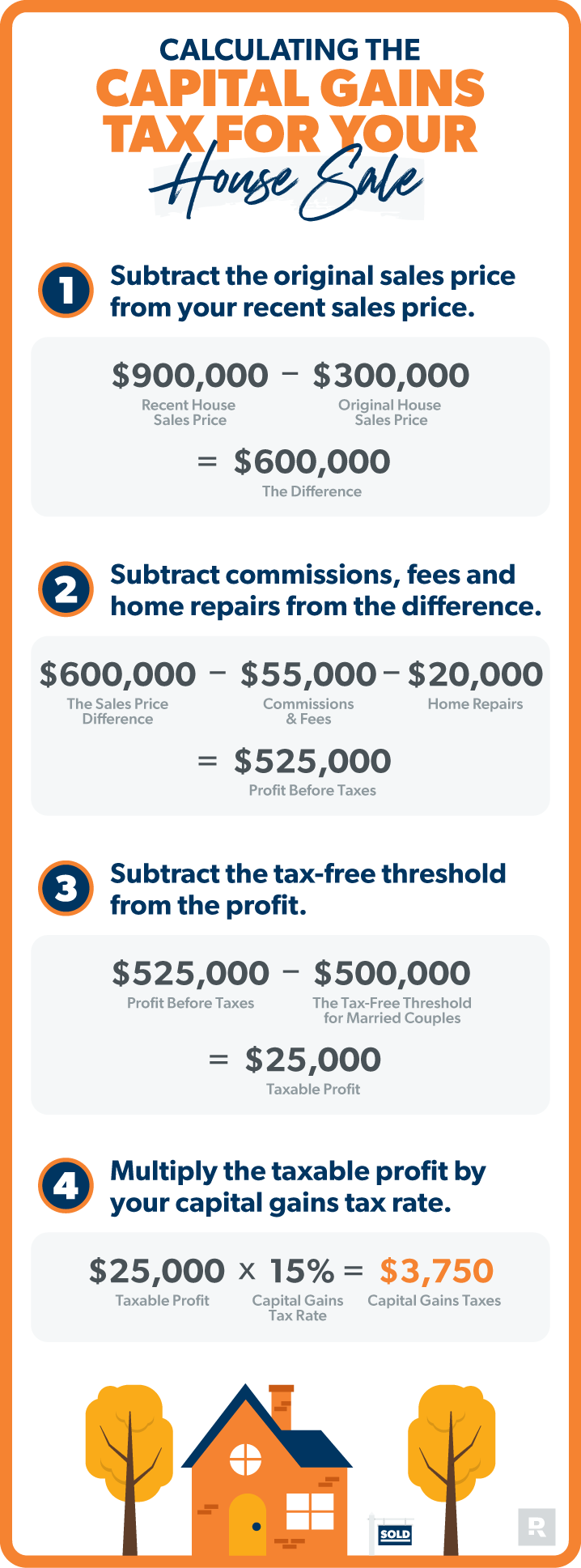

Wisconsin has a state income tax that ranges between 4000 and 7650. The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a married. 6123 5602 Net realized investment gains before taxes 295 1198 Income tax expense 1 62 252 Net realized investment gains after taxes 233 946 Net operating earnings 37681 25531.

Taxable income of 0 to 10275. Rather it is a percentage of the profit. Tax rate Single Married filing jointly Married filing separately Head of household.

For many sellers it is relatively simple to meet that mark. For Simple Federal Returns Fast and easy tax filing for simple returns 39 95 State Additional Benefits Forms Requirements 100K Accuracy Guarantee Our accuracy guarantee is more than our wordits backed by 100k. Some states also have their own state capital gains tax.

This provision applies to tax years beginning on or after January 1 2023. IA-1040 is the long-version Iowa 1040 income tax return for use by all in-state residents. If you had Iowa tax withheld and are requesting a refund or if you choose to file an Iowa return even if you are not required to do so enter.

Form IA 1040 requires you to list multiple forms of income such as wages interest or alimony. Reporting Capital Gains and Losses Publication 103 Back to Table of Contents 3 1. INTRODUCTION Gains and losses from sales or other dispositions of capital assets are reportable for both Wisconsin and federal income tax purposes.

Long-Term Capital Gains Tax in Georgia. This version of IA-1040 is a PDF form that can be filled out and printed for easy filing. Enter 100 of qualifying capital gains deduction that are attributable to Iowa sources.

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. Just like with income tax the capital gains tax is not a flat fee. Iowa earned income tax credit.

The action has left some policymakers and practitioners perplexed. The Wisconsin capital gains tax rate favors the seller better than the rates of Iowa Vermont New York Washington DC Minnesota Oregon New Jersey Hawaii and California. The law modifies the capital gain deduction allowed for the sale of real property used in a farming business beginning in tax year 2023.

See form IA 100 for instructions. The most commonly known cost associated with selling your home is the capital gains tax. However differences exist in the way Wisconsin and federal law treat such income and loss.

The current tax year is. Child and dependent care credit OR 60Early childhood development credit 00 00 61. The percentage will change based on your tax bracket.

This tax change is effective for tax years ending after March 3 2020 so it applies to both first draw and second draw loans forgiven in 2020 and 2021. As of February 2021 the following states do not charge their own capital gains tax. Iowa Capital Gain Deduction for certain businessfarm assetsESOP stock ONLY.

On June 8 2021 H436 was enacted in Vermont fully conforming the state to the federal tax treatment of PPP loans forgiven in 2021. For the 2020 tax year the short-term capital gains tax rate equals your ordinary income tax rate your tax bracket. Iowa fuel tax credit.

Undistributed Capital Gains Tax Return must be filed by the REIT if it designates undistributed net long-term capital gains under section 857b3C. Listen as Brad and Nikki discuss the compliance challenges businesses face following Wayfair as well as Brads ongoing advocacy. Capital Gains Exclusion Tax Deductions When Selling A House.

150 15 of federal credit61. As with everything you need to meet the IRSs threshold.

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

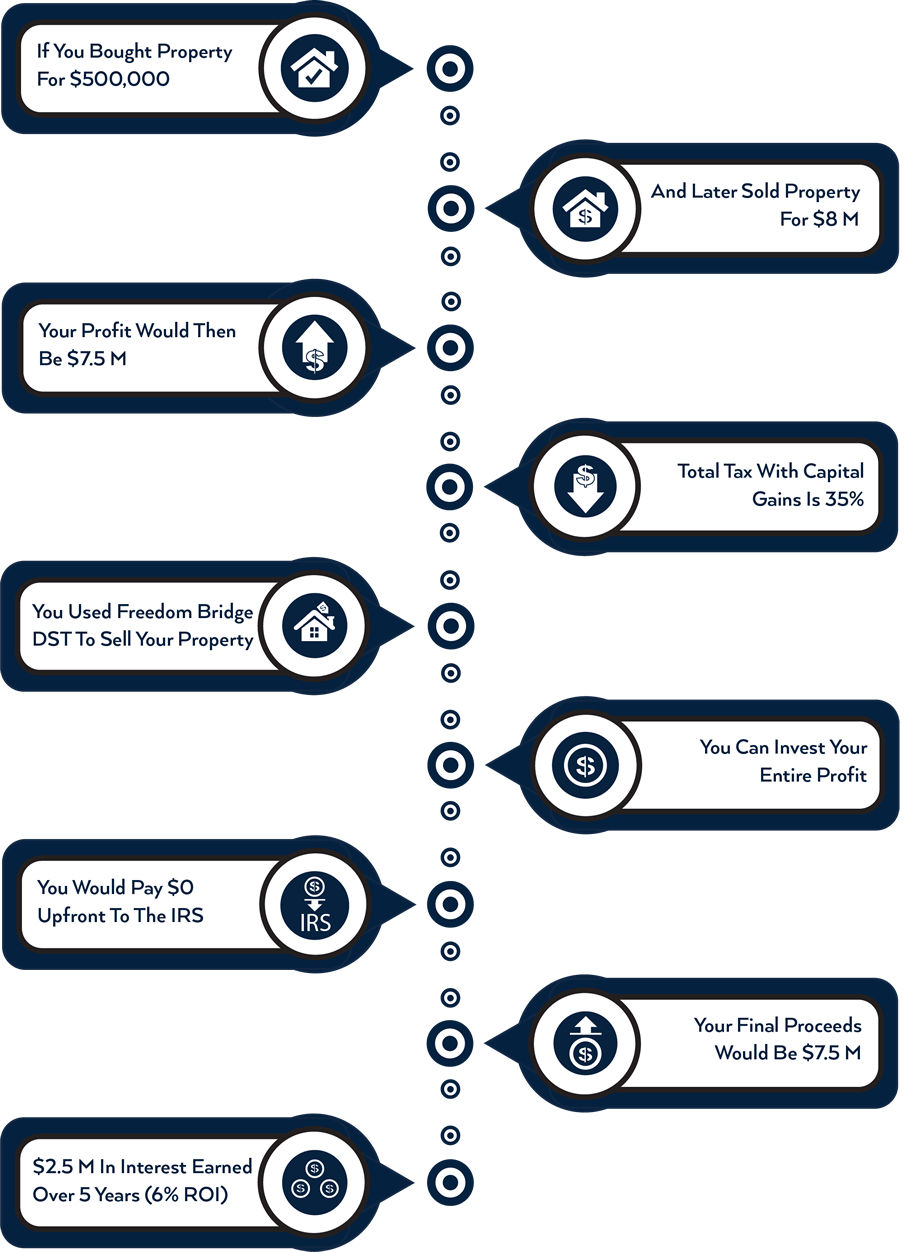

Iowa S New Tax Structure In 2022 And Beyond

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

Http Taxworry Com Period Of Holding How To Compute In 11 Situations Capital Gains Tax Hold On Taxact

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Paying Capital Gains Tax In Iowa Stocks Cryptocurrency Property

Pin On Farm Succession Transistion

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

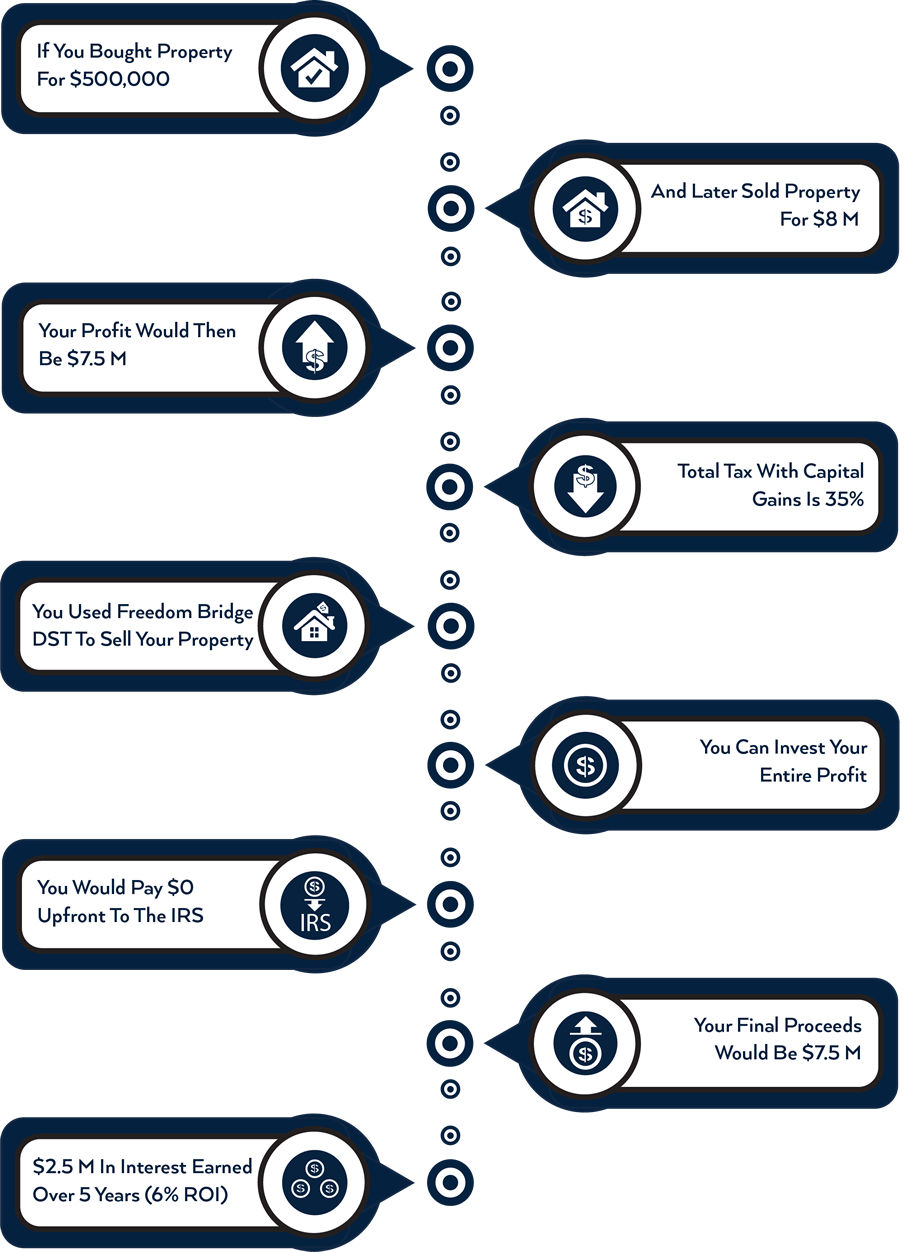

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Retirees Farmers Will See Big Benefits From Iowa S New Tax Law Business Record

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Notice From Cpc Tds To Persons Who Registered Home In Fy 2013 14 Who Should Not Bother Too Much Taxworry Com Cpc Bothered Capital Gains Tax

Income Tax Calculation Fy 2019 20 Salaried Employees Standard Deduction Rebate U S 87a Cess Youtube Standard Deduction Income Tax Income

Condonation For Delay In Generation Of Udin Till 28 Th February 2021 Generation Delayed Till

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Sale Tax Deductions

Capital Gains Tax Iowa Landowner Options

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Best Financial Planners Fee Only In India Financial Planner Financial Advisors Financial